Bluestone

Bluestone partnered with Digital Stand to centralise loan support and boost broker marketing using HubSpot, improving efficiency and insights.

Overview

Bluestone is a specialist non-bank lender supporting a growing network of brokers and customers across Australia. Before working with Digital Stand, Bluestone lacked a centralised platform for loan support, had minimal broker segmentation, and limited insight into marketing performance. Although some marketing automation existed, it was under-utilised due to poor structure, lack of segmentation, and minimal reporting.

Centralise loan support operations and optimise broker communications with automation and segmentation.

Implemented HubSpot’s Service Hub to manage loan enquiries and Marketing Hub for broker engagement and reporting.

Completed over a structured engagement period tailored to immediate impact and scalable growth.

Key Challenges

01.

No Central Loan Support System

Without a unified platform, customer loan support was fragmented across multiple channels, leading to inconsistent service and slower response times.

02.

Inefficient Broker Marketing Automation

Marketing automation was poorly segmented, causing generic outreach that failed to engage brokers effectively or scale communication efforts.

03.

Limited Interaction Visibility

There was insufficient insight into customer and broker touchpoints, making it difficult to track engagement and tailor communications appropriately.

04.

Inadequate Reporting and Attribution

Campaign and service performance data were scattered and incomplete, preventing accurate measurement of marketing ROI and broker engagement.

Process

Bluestone and Digital Stand collaborated to identify key service bottlenecks and marketing gaps. We designed workflows and segmented data to streamline loan support and broker communications, ensuring measurable improvements in automation and reporting.

Our Solutions

Digital Stand implemented HubSpot Service Hub and Marketing Hub to deliver a unified system for loan support and broker engagement.

-

Service Hub Implementation (Loan Support)

We created a dedicated ticket pipeline to manage all loan enquiries, with custom properties for enquiry types, loan stages, and resolution times. Automated workflows routed tickets, triggered alerts, and tracked SLAs, while centralising email and call logs for a complete support history.

-

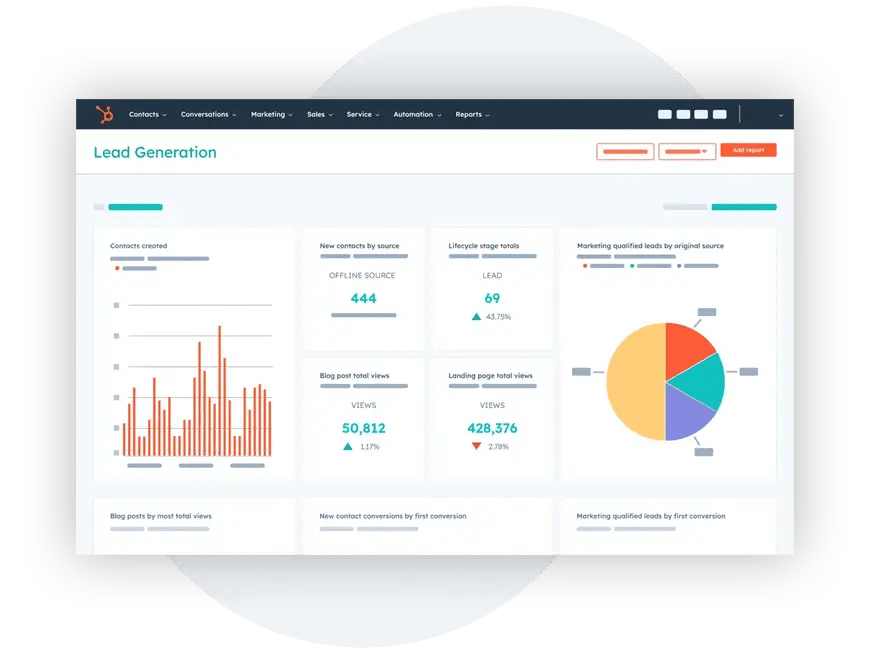

Marketing Hub Optimisation (Broker Engagement & Growth)

The marketing database was restructured with broker segmentation by region, engagement, and channel. Lead lifecycle stages were defined with a custom scoring model. Dashboards tracked campaign metrics, alongside standardised naming and UTM tagging for accurate attribution.

Results That Speak for Themselves

Bluestone’s new HubSpot platform revolutionised loan support and marketing, delivering measurable improvements.

Full visibility and management of loan enquiries in one system.

35% increase in performance reporting accuracy and depth.

Segmented and personalised communications at scale.

Automated workflows tailored by broker lifecycle stage.

Unified Platform Driving Growth and Efficiency

With Service and Marketing Hubs working seamlessly in harmony, Bluestone now delivers consistent, automated loan support alongside scalable and targeted broker engagement. This powerful, unified platform has brought greater clarity, improved operational efficiency, and enhanced growth readiness, significantly elevating the experience for both customers and partners alike.

.jpeg?width=200&height=200&name=pexels-mikhail-nilov-6893349%20(1).jpeg)